Basis of Investment Decisions and Approach Giving You the Best Odds of Success

Focus on personal opinion of managers

Attempt to identify the 30%, and whether it is skill or luck

Greater chance that any one investment impacts wealth

Pay for something with no clear evidence of added value

More than 50 years of academic research in finance

More than 70% of managers underperform

Over 10,000 stocks in markets around the world

Over 1% average fund expense ratios

Focus on persistent drivers of investment performance

Treat markets as an ally and let them work for you

Spread investment risks as much as possible

Keep more of your money by using cost effective funds

Source: Morningstar and S&P Index vs. Active quarterly report.

Diversification does not eliminate the risk of market loss.

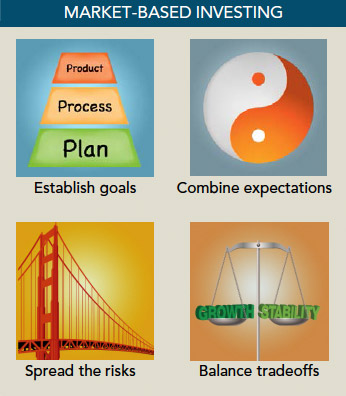

Implementation of Investment Approaches

Predictive-based investing, limited diversification

Market-based investing, seeks to capture returns of broader group of investments

Traditional Active Management

Bets on individual investments, or short term market timing

Index Management

Diversified Exposure to Groups of Investments

Tax Management

Dimensional

Diversified Exposure to Groups of Investments

Tax Management

Integrated Portfolio Design, Management and Trading

Consistent Investment in Asset Classes

Precision and Exclusions

Avoid Index Reconstitution

Effect

Momentum Screens