Our Philosophy

Compass Financial Strategies offers institutional-grade portfolio management to individual investors and institutions. Compass helps serious investors navigate the unpredictable world of investing.

We believe:

- markets are efficient,

- risk and return are related, and

- asset allocation drives returns – not security selection.

The hypothesis states:

- Current prices incorporate all available information and expectations.

- Current prices are the best approximation of intrinsic value.

- Price changes are due to unforeseen events.

- Mispricings do occur, but not in predictable patterns that can lead to consistent outperformance.

The implications:

-

Active management strategies cannot consistently add value through security selection and market timing.

- Passive investment strategies reward investors with capital market returns.

In this new model of investing, our state-of-the-art portfolios are based on five governing principles:

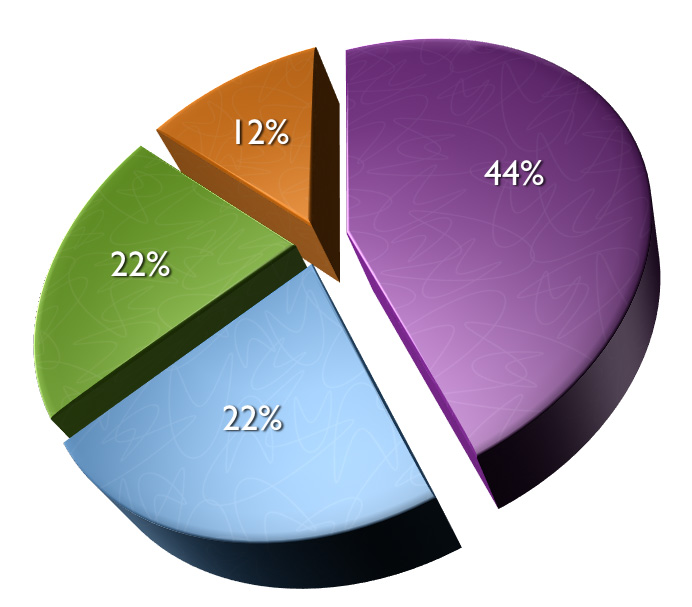

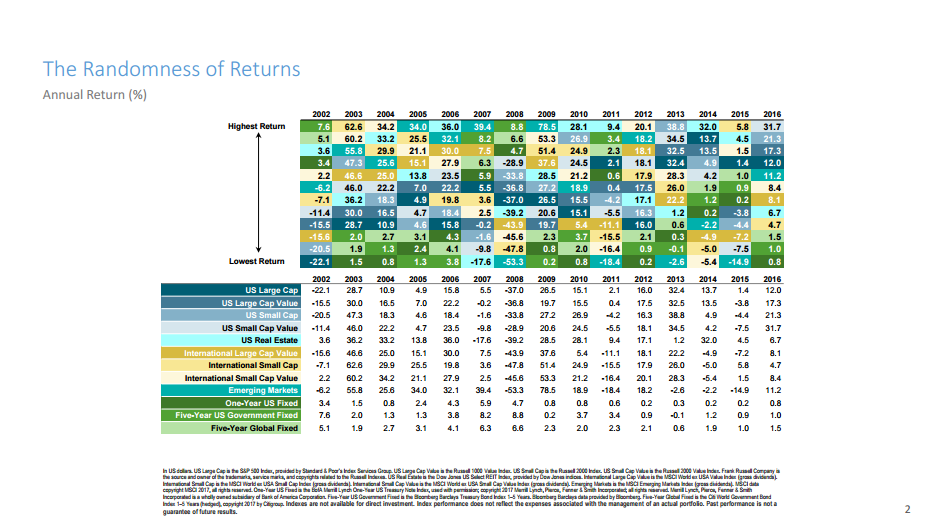

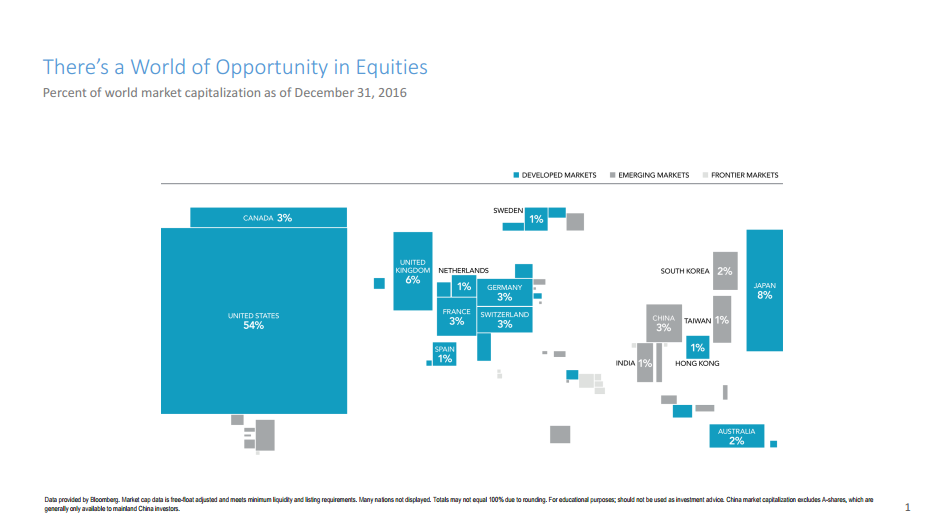

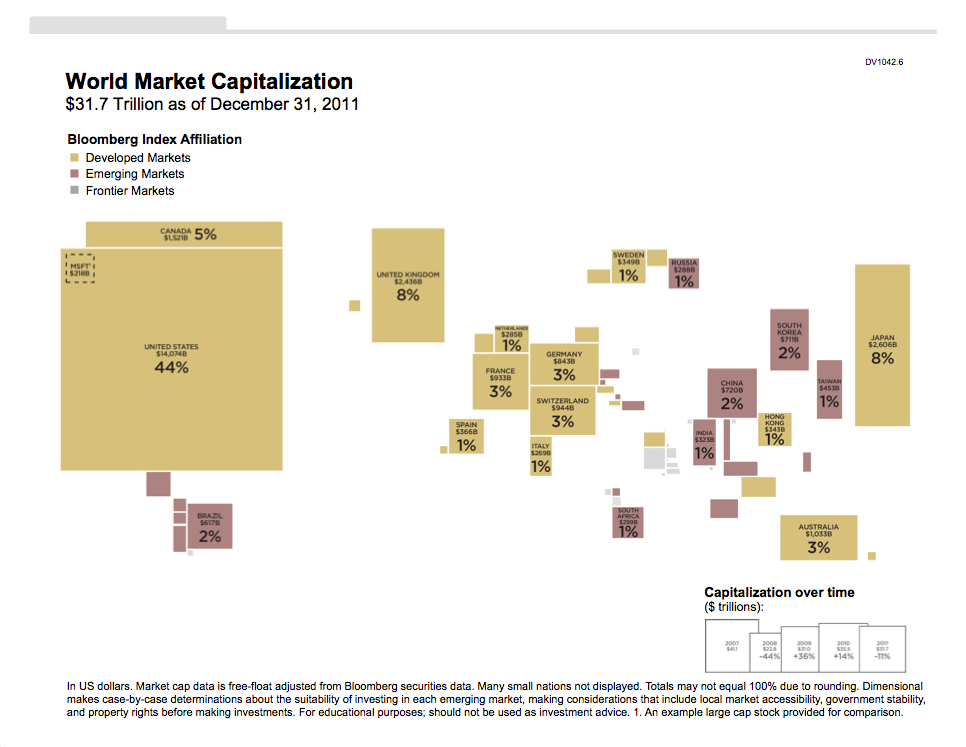

World markets are random and unpredictable; therefore, diversification is important for investors in the world market. The familiar axiom “don’t put all your eggs in one basket” certainly applies here.

- The U.S. economy represents approximately 44 percent.

- International developed markets represent approximately 22 percent.

- Emerging markets represent approximately 22 percent.

- Frontier markets represent approximately 12 percent.

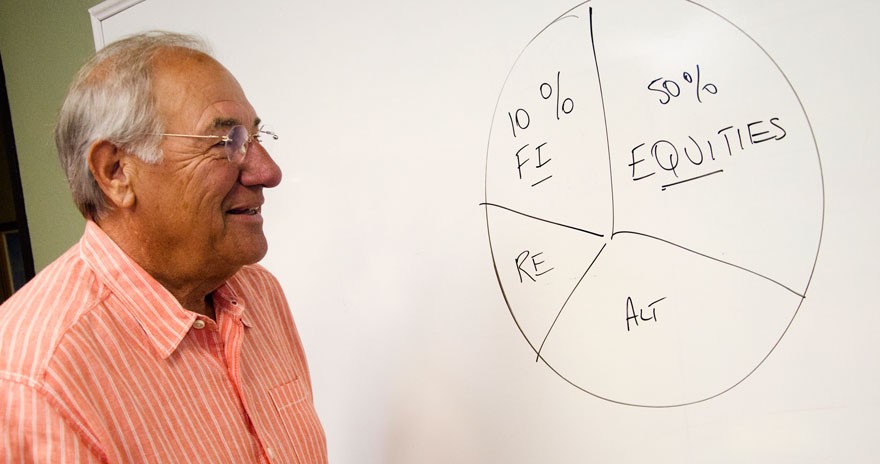

Asset allocation pertains to owning a portfolio that includes debt and ownership.

Asset allocation pertains to owning a portfolio that includes debt and ownership.